For millennials wrestling with the idea of purchasing a home in the New Year, feelings of fear and anxiety are to be expected. The reality is, young homebuyers are in a very vulnerable and difficult position, as they will face higher rates than the generations before them and many will have to simultaneously try to pay down debt from schooling and other expenses as well.

To provide our young readers with as much knowledge as we can about this current situation and what they face, we’ve taken the opportunity to respond to some basic mortgage concerns they may have.

- Know Your Credit Scores: Your credit score is your key to accessing loans that will make your dreams of owning a home a reality. A good credit score will improve your ability to request and receive a generous loan from the bank, but if your score is low, you’ll have to build better credit before you can consider owning a home

- Document Your Work History: Lenders will ask to see your work history, as they need to know that you can keep a job and have a steady income, allowing you to pay them back. Be prepared to show at least two years proof of consistent employment.

- Save Your Money: Homeownership costs go above and beyond your monthly mortgage payments. You’ll need to save for closing costs, property taxes, insurance, and any upgrades or renovations you’re looking to make. You can start off by opening an RRSP account and take advantage of RRSP mortgages. Save above and beyond what you think you’ll need – just to be safe.

- Rent If You Have To: If buying a home is not a reality for you right now, it’s time to adjust your expectations. By renting a home for a while, you’ll have more time to build your credit and save for a home in the future. Home purchasing is a big decision that should never be made impulsively.

- Be Selective In How You Choose To Pay: The option to pay with cash, debit, or credit is more than just convenience. Paying with cash for anything can be risky, as there is no paper trail to document your purchase. When lenders review credit history or bank statements, be sure to have them ready and that sufficient transaction history is documented. You should also limit the amount of money you move from one count to another and avoid being paid for anything in cash. Proof in documented numbers matters.

- Investigate Down Payments: It is a myth that 20% down payment is required on all loans. Ask your mortgage broker about the options available to you. There are also first-time homebuyer programs that can help you with your decision. Ask a mortgage broker for more details.

- Go After Preapproval: Getting pre-approval on your mortgage can guarantee an interest rate. Be sure that the lender has already viewed your financial documents before you begin shopping. Through pre-approval, you’ll be able to identify what homes are in your price range and you may even be able to leverage your pre-approval in the bidding-war process.

- Have The Home Inspected: If you’ve found a home you like, DO NOT bypass the inspection. Do your due diligence to ensure you’re making a good investment and that you’re not biting off more than you can chew. Extensive home renovations can suck your hard earned dollars right down the drain.

Securing a Low Mortgage Rate

One of the most important aspects of taking out a mortgage is the process of securing a low-interest rate – keeping monthly payments as low and manageable as possible.

Why does this matter?

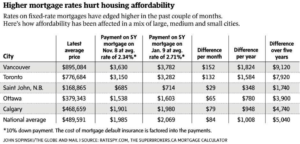

Slight increases in rates can mean hundreds and thousands of dollars in additional costs every year.

“First-time home buyers are hit the hardest by the recent mortgage rate increase, notably in bigger cities. A couple that buys a house in Toronto at the November average price of $776,684 might be looking at an extra $132 per month or $7,920 over five years”. – Rob Carrick, The Globe and Mail

Numbers To Know

- Mortgage rates are offered in eighths, such as 2%, 2.125%, or 2.25%.

- There are two different types of rates, Fixed and Variable

- Often banks will advertise their posted rates, but they will discount them based on the quality of the borrower.

- Sometimes you will see a higher advertised rate, that’s because the APR has been added (the cost of obtaining the loan)

- There are also different mortgage products that service clients with specific issues, self-employed, soft credit profile, etc., the higher the risk the higher the rate.

Millennial Mortgage Checklist

Before you get started, it’s critical that you organize and file all of the right documents. Use the checklist below to begin preparing for next steps:

- Government issued ID’s

- Bank statement – typically 90-day history

- Up to date credit reports (banks will always request directly from Equifax)

- Employment records and verification (typically a letter of employment and recent pay stub)

- T4 forms

- Tax return documents and recent Notice of Assessment

How The Mortgage Station Can Help

For those looking to take out a new mortgage or a first mortgage, our advice is to always get pre-approval. We also suggest that you do your research to review your income type, down payment sources, and the amount you’ll need to cover closing costs.

We can help by offering a credit report review. Your scores are important, but you also need a healthy credit profile. For example, a $500 credit card for 2 years is not going to secure a mortgage.

We can also help by developing a “Buying plan” for those who are just looking into buying or those not quite ready yet. Through our years of experience in working with 40 Canadian lenders and all five sources of mortgage funds in Canada, we can help to set you up for financial success.

Call us today at 1-877-512-0007 today!