8 Ways to Financially Recover from Holiday Overspending

Overspending during the holidays can put a crippling hold on your finances as you enter the New Year. While buying expensive Christmas gifts and indulging in Boxing Day sales may have felt good and “worth it” at the time, as credit card bill rolls in, and monthly bills pile up, we understand how overwhelmed Canadians may be feeling.

Our advice? Take a breath. It’s happened to the best of us.

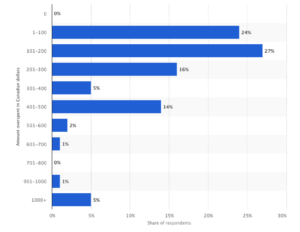

In fact, it’s happened to many of us. In 2016, statistica reported that 27% of respondent Canadians overspent on the holidays by $101 to $200, that 14% overspent $401 to $500, and that 5% overspent by $1000 or more.

And if you are a person who also fell victim to overspending during the holidays, the important thing now is to tighten your budget, reduce your spending, and to consult a financial advisor who can get you back on track before your credit begins to truly suffer.

Your Financial Options

Your best option to regain financial control is to consolidate your debt. Debt consolidation will help you to simplify your finances, save money, manage monthly payments in a less stressful way, and you’ll be able to pay your debt off sooner.

Consolidating Debt

Consolidating debt allows individuals to pay off their consumer debts by taking out a new loan that combines multiple debts into a single pool of debt. This means that you can pool your car loan, your mortgage, and your credit cards debt into one – making it easier to manage. This typically offers better pay off and can help you to balance out your debt when re-evaluating your finances after the stress of the holidays.

However, it is important to note that your eligibility for debt consolidation is based on your credit score, finances, and debt repayment goals – so be sure to consult a financial advisor to determine what options are logical and right for your situation.

Recovering From Overspending

In addition to consolidating your debt, you must also adjust your spending habits – as debt consolidation is not an excuse to continue over-spending. Below are some helpful tips to ensure you are spending your money smartly:

1. Make a Weekly Budget

One of the best things you can do is to outline and map out a weekly budget for how much you will need to spend on your bills, and how much you can spend on groceries and necessities like shampoo or deodorant.

While you may have enough extra money to spend on entertainment, clothes, or activities, that doesn’t mean you should spend it. Instead, put the extra money into your savings and only touch that money in an emergency.

2. Make Food At Home

While eating dinner at a restaurant or ordering take out can be fun, convenient, and delicious, food is one of the items people most overspend on.

Instead of spending $60 on a dinner out, or buying your lunch every day at work, purchase your groceries strategically and don’t let the food at home go to waste!

3. Cut Down on Utilities

It’s time to conserve! That means turning off the lights when you’re not using them, using less water, and cancelling your cable and phone if they aren’t necessities. You can save big money by cutting down on your monthly bills.

4. Consider Making Homemade Personal Gifts

Whether for Christmas, Valentine’s Day, or a birthday, cut your spending by reducing the amount you spend buying gifts for others. Thoughtfulness can go a lot farther than expense; so consider the ways you can personalize smaller gifts that will make a larger emotional impact than something flashy or extravagant.

5. Sell Unwanted & Unneeded Goods

To make some extra cash that you can save for groceries and utilities, sell unwanted goods that you no longer need or don’t want. Post your items on Varage Sale or Facebook to see if any of your friends or peers are interested in what you’re selling. You’ll free up some space in your home, and have extra money to take off some of the burdens of your bills.

6. Stay In

We’re not saying you can’t have fun, but you’ll need to readjust what your idea of “fun” looks like. While it’s okay to give yourself a small treat every once in a while, gone are the days you can go to the movies whenever you want or browse the mall and “pick up a few things”.

Instead, close your wallet and invite your friends over to have a fun night in. You’ll reduce your pressure to buy and make some fun memories playing cards, talking, or spending time in your back yard!

7. Smart Commute

To reduce the amount of money you’re spending on gas, carpool, use public transit, walk, or bike to work or around town. It isn’t cheap to own and buy fuel for a car, so be sure to explore your options and either leave the car at home, downgrade your vehicle, or sell it!

8. Contact The Mortgage Station

To learn more about your financial options, speak to an agent at The Mortgage Station today – 1.877.512.0007. Our team is equipped to assess and address you current financial situation and to provide options that will best benefit you.

Let us help get you back on track towards financial freedom.