Mortgage Agent vs Broker vs Specialist: 9 Key Differences

Don’t wait! Speak to a Mortgage Agent or Broker now by calling The Mortgage Station at 1-877-512-0007.

The mortgage industry can be complex and confusing, with various professionals and licensing classes. If you’re looking for help with your mortgage options, it’s essential to know the differences between a Mortgage Agent vs Mortgage Broker vs Mortgage Specialist. At The Mortgage Station, our full-service mortgage brokerage offers the best mortgage options for your unique financial goals. In this article, we’ll explore the key differences between these professionals, including how the updated licensing classes introduced in Ontario starting April 1, 2023, affect each.

Contact us to discover your best mortgage options!

Table of Contents

1. Services Offered

Mortgage Agents and Brokers can help you find the best mortgage options based on your unique financial goals. They work with a wide range of lenders to provide you with a variety of mortgage products, including:

- Purchasing property

- Refinancing

- Debt consolidation

- Equity mortgages

- RRSP mortgages

- Private mortgages

- Investment properties

- Reverse mortgages

- Construction mortgages

Mortgage Specialists can also present mortgage options but are limited to offering only the mortgage products provided by the financial institution they represent, which means fewer options for you.

2. Licensing Classes

Mortgage Specialists are not required to be licensed, though their financial institution may offer some training. This is not the case for Brokers and Agents, who are required to be licensed. Beginning April 1, 2023, Ontario now has three new licensing classes set out by the Financial Services Regulatory Authority (FRSA) for Brokers and Agents: Mortgage Agent Level 1, Mortgage Agent Level 2, and Mortgage Broker. Each licence has different levels of authority and education requirements.

Mortgage Agent Level 1 allows you to work only with certain types of lenders.

Mortgage Agent Level 2 can work with a wider range of mortgage lenders, including mortgage investment companies, private individuals, and other agents or brokers.

A Mortgage Broker licence permits the same activities as Mortgage Agent Level 2 but also allows supervision of Mortgage Agents (levels 1 and 2). A Mortgage Broker licence also allows the licensee to act as the principal broker for a brokerage.

At The Mortgage Station, we only have Mortgage Agents Level 1 as part of our training program on the way to Mortgage Agent Level 2 and above. All our new agents, regardless of licence level, are matched with a mentor that must have a Mortgage Brokers licence, ensuring that our team has the expertise and access to a wide range of lenders to provide the best mortgage solutions for our clients.

Here are five things to consider when choosing a mortgage broker.

3. Education and Experience Requirements

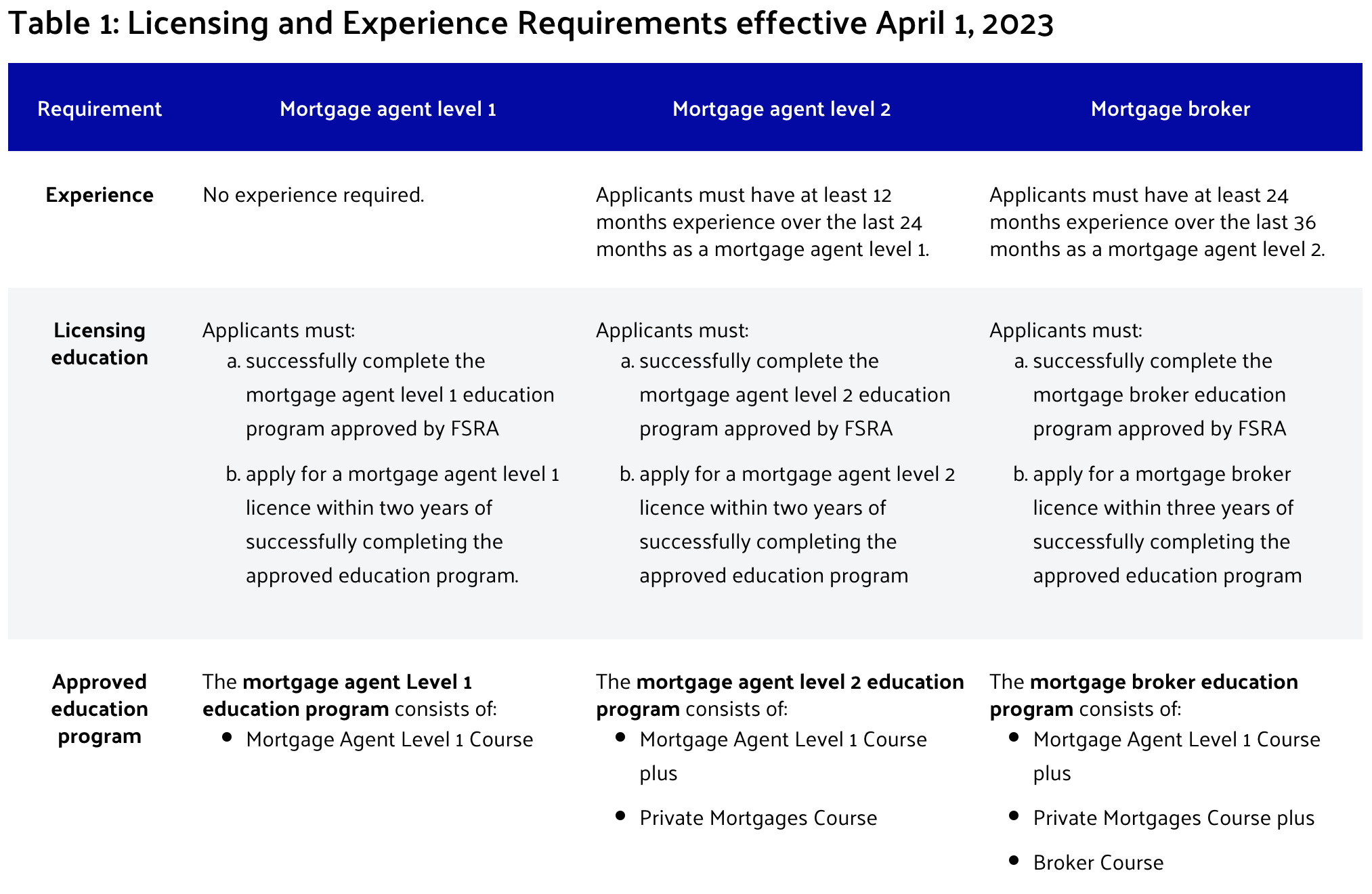

When it comes to a Mortgage Agent vs Mortgage Broker, each licence has specific education and experience requirements. For example, Mortgage Agent Level 1 requires no previous experience and the completion of an FSRA-approved Mortgage Agent Level 1 education program, while Mortgage Agent Level 2 and Mortgage Broker licences require 12 and 24 months of experience, respectively, along with additional education.

Again, because Mortgage Specialists are employed under a financial institution and only able to sell their respective mortgage products, they are not required to be licensed, meaning they do not need to complete these education and experience requirements.

Table courtesy of the FSRA

4. Range of Lenders

Mortgage Agents Level 1 can only work with specific types of lenders, such as financial institutions or those approved by the Canada Mortgage and Housing Corporation (CMHC). Mortgage Agents Level 2 and Mortgage Brokers, on the other hand, can work with a broader range of mortgage lenders, including mortgage investment companies, private lenders, and even other agents or brokers. Mortgage Specialists are typically affiliated with a single financial institution and may only provide mortgage products from that institution.

5. Supervision and Training

Mortgage Brokers can supervise Mortgage Agents Level 1 and 2 and act as the principal broker for a brokerage. Level 2 Mortgage Agents and Brokers can also bring in Level 1 Mortgage Agents in private mortgage transactions for training, but Level 1 Mortgage Agents cannot claim to be qualified for these kinds of transactions. Level 2 Mortgage Agents and Brokers are ultimately responsible for those transactions.

6. Continuing Education Requirements

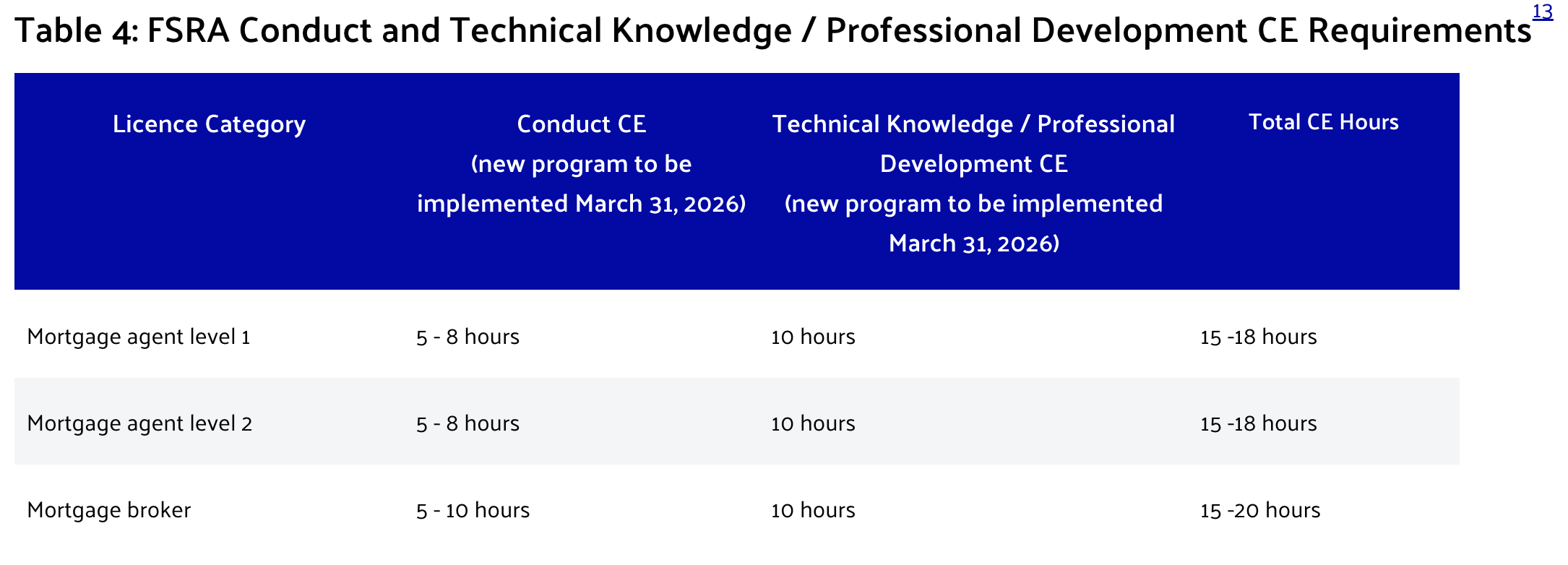

Mortgage Agents and Brokers are still required to complete their Continuing Education (CE) every two years, but new CE requirements for licence renewal for Mortgage Brokers and Agents have now come into effect. These requirements are meant to ensure that licensees stay up to date on their industry skills and knowledge, and they include two types of learning – Conduct CE and Technical Knowledge/Professional Development CE.

Table courtesy of the FSRA

7. Independence

Both Mortgage Agents and Brokers are independent professionals who work with a variety of lenders to find the best mortgage options for their clients. They are not tied to any specific financial institution, which often gives them the opportunity to provide unbiased advice and tailor-made solutions. Mortgage Specialists, however, are usually employed by a financial institution and will leverage their employer’s available products.

8. One-Stop Shop

A full-service mortgage brokerage like The Mortgage Station offers a one-stop shop for all your mortgage needs. Our team of experienced Mortgage Agents and Brokers can help you navigate the sometimes complicated mortgage process, from finding the best mortgage rates to guiding you through application and approval. With our extensive network of lenders, we can provide you with a wide range of mortgage products and options to suit your financial situation and goals.

Contact us today to learn more!

9. Personalized Service

At The Mortgage Station, our team of Agents and Brokers are committed to providing personalized service and expert advice throughout the mortgage process. Our goal is to build long-lasting relationships with our clients, ensuring that we understand your needs in order to provide tailored mortgage solutions that help you achieve your dream of homeownership.

In conclusion, understanding the differences between a Mortgage Agent vs Mortgage Broker vs Mortgage Specialist is crucial when navigating the mortgage industry and your financing options. Luckily, at The Mortgage Station, our experienced and licensed Mortgage Brokers and Agents offer tailored services, access to a wide range of lenders, and expert guidance to help you reach your goals.

Email us at info@themortgagestation.ca or call us at 1-877-512-0007 to discuss your mortgage needs!